Unlocking New Realities

MANAGE YOUR VANILLA PREPAID CARD BALANCE

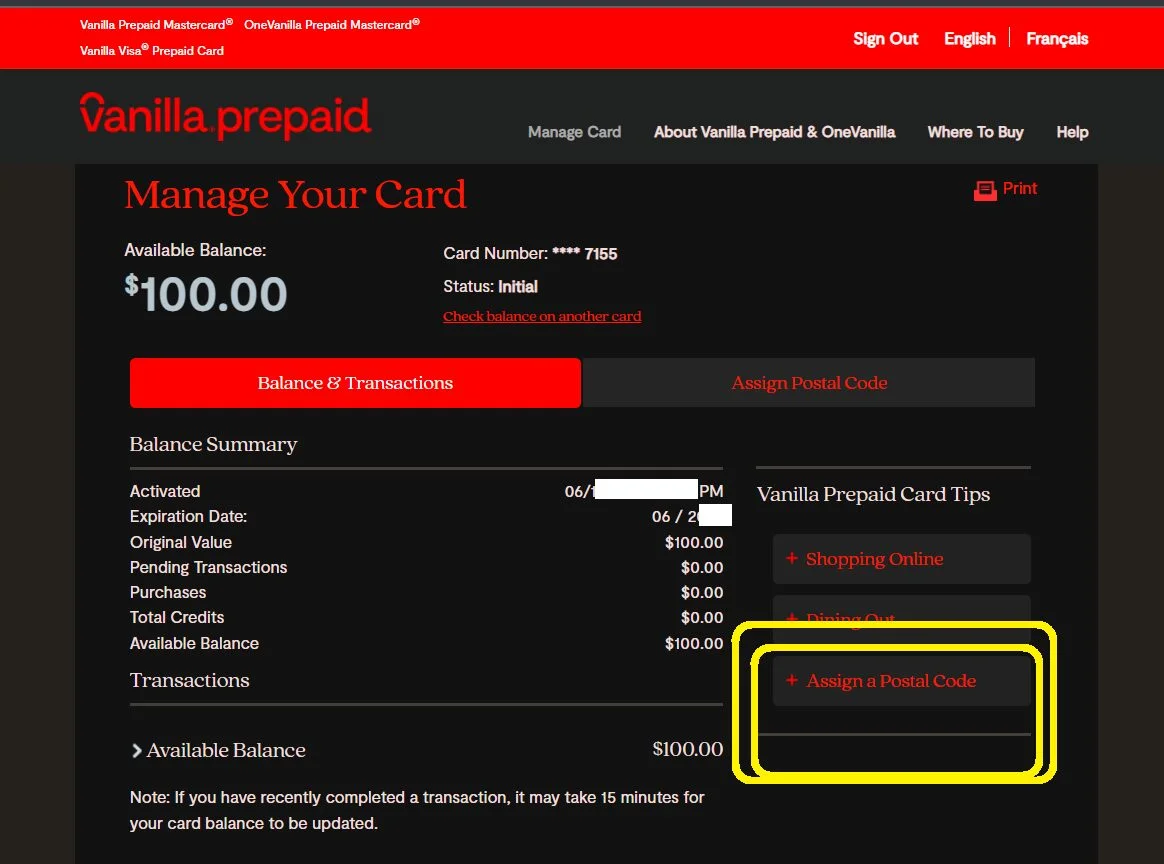

With our Vanilla Prepaid Card, managing your finances has never been easier. Our user-friendly platform allows you to check balances, monitor transactions, and stay in control of your spending, whether you’re using a Debit MasterCard or a Visa debit card.

What We Do

VanillaPrepaid Cards Benefits

Experience the advantages of Vanilla Prepaid Cards, designed for secure and convenient financial management. Whether you opt for a Debit MasterCard or a Visa debit card, our services offer unparalleled flexibility and peace of mind.

Our Experiences

EASY MONEY MANAGEMENT

Simplify your financial life with Vanilla Prepaid Cards. Keep track of your funds effortlessly and stay in control of your spending.

ENHANCED SECURITY

Trust our state-of-the-art security solutions to protect your funds. With Vanilla Prepaid Cards, your financial assets are safeguarded.

EXPERT CUSTOMER SUPPORT

Our dedicated support team is available to assist you whenever you need help with your Vanilla Prepaid Card. Count on us to optimize your card experience.

ACTIVATE YOUR VANILLA PREPAID CARDS EASILY

Activating your Vanilla Prepaid Card is a breeze. Follow a few simple steps to start using your card. Whether it’s a gift card, a prepaid debit card, or a reloadable card, we make sure activation is quick and secure.

Are you looking for a versatile payment solution that offers convenience and flexibility? Look no further than Vanilla Prepaid Visas. These prepaid cards are accepted at numerous locations worldwide, making them perfect for everyday purchases and travel expenses. Whether you’re shopping online or in-store, Vanilla Prepaid Visas provide the freedom to pay securely and conveniently.

One of the key benefits of Vanilla Prepaid Visas is their widespread acceptance. These cards are welcomed wherever Visa cards are accepted, including retail stores, restaurants, and online merchants. From grocery shopping to dining out, you can use your Vanilla Prepaid Visa to make purchases with ease.

In the unfortunate event that your card is lost or stolen, there’s no need to panic. Vanilla Prepaid Visas come with robust security features and protection against unauthorized transactions. Simply report the loss or theft promptly, and your card can be deactivated to prevent any unauthorized use. Plus, with the option to check your gift card balance online, you can easily monitor your transactions and ensure peace of mind.

With Vanilla Prepaid Mastercard, managing your finances has never been easier. Keep track of your spending and budget effectively by checking your gift card balance regularly. You can also reload your card with additional funds as needed, ensuring that you always have sufficient funds available for your purchases.

Another convenient feature of Vanilla Prepaid Visas is the ability to use them at gas stations. Whether you’re filling up your tank on a road trip or simply running errands around town, your Vanilla Prepaid Visa is accepted at most gas stations, providing added convenience and flexibility.

It’s important to note the expiration date of your Vanilla Prepaid Visa to avoid any inconvenience. Plan your purchases accordingly and make the most of your card before it expires. With careful planning and budgeting, you can maximize the value of your Vanilla Prepaid Visa and enjoy seamless transactions wherever you go.

In summary, Vanilla Prepaid Visas offer a convenient and secure payment solution for a wide range of needs. Whether you’re shopping for groceries, dining out with friends, or traveling abroad, these versatile cards provide the flexibility and peace of mind you need. Experience the convenience of Vanilla Prepaid Visas today and discover the freedom to pay anywhere Visa cards are accepted.

About Vanilla Prepaid Cards

Discover the world of Vanilla Prepaid Cards, where secure and convenient money management meets simplicity and reliability.